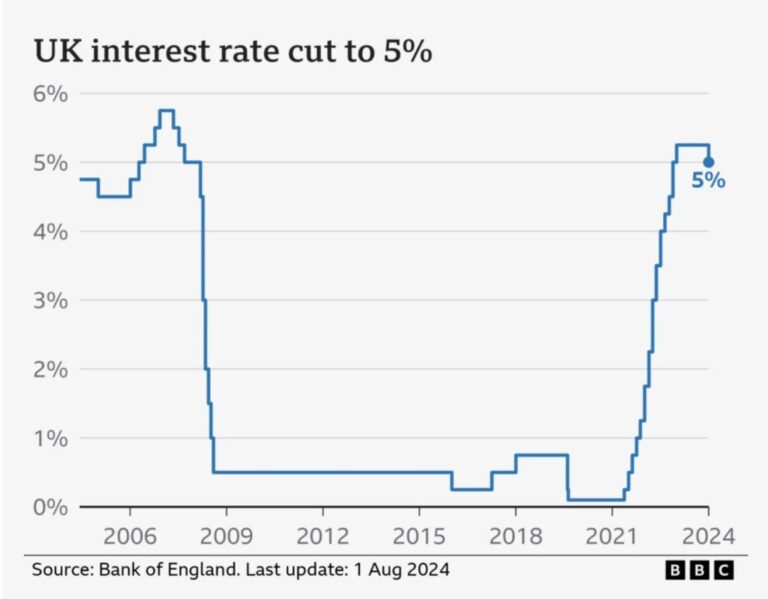

Earlier this month, the Bank of England made the significant decision to cut interest rates from 5.25% to 5%, marking its first reduction in over four years. Experts say this move signals the central bank’s belief that inflation is finally under control.

Lucian Cook, head of residential research at Savills, said “This move should give buyers and sellers the confidence that the housing market will improve as we head into 2025.”

Lucian Cook, head of residential research at Savills, said “This move should give buyers and sellers the confidence that the housing market will improve as we head into 2025.”

“As a result of the cut, mortgage rates will be on course to return to more affordable levels, gradually improving the range of buyers in the market and their buying power”

At Value Invest, we forecast more base rate cuts coming soon, and a growth in the market activity over the next few years.

Mr. Cook points out that as a result of the cut, mortgage rates are likely to decrease resulting in more accessible home financing that will boost buyers’ purchasing power. This shift is expected to increase market activity by the next Fall, especially in the case of additional rate cuts being implemented in the near future.

–

–

Additionally, Robert Gardner, Nationwide’s (UK largest mortgage lender) chief economist, said if the UK economy kept recovering steadily, then housing market activity was “likely to strengthen gradually as affordability constraints ease through a combination of modestly lower interest rates and earnings outpacing house price growth“.

House prices today remain about 3% below the all-time high recorded in the summer of 2022 during the post-pandemic boom in the property market, which was encouraged by very low borrowing costs. The average house price stood at £265,375 in August, Nationwide said.

House price growth relies on further reductions in borrowing costs. The Head of Residential Research of Savills forecasts a plus 2.5% growth this year, supporting their forecast for total house price growth of 21.6% over the next 5 years.

The interest rate cut gives real estate investors a strategic advantage.

As mortgage rates decline, investors can anticipate a boost in market activity, resulting in a dynamic environment that favors long-term investments and with the potential for significant gains over the next few years.

Another sign of the U.K. property market is continuously growing and providing opportunities to investors who make strategic moves and enjoy its benefits, such as great rental yields, lower borrowing costs, and valuable assets.

Investing in the UK property market requires thorough research to make sure you’re investing in the right areas, trust in the developers, and patience until completion. With the help of our expert team in Value Invest, we can guide your way to wealth accumulation.

Value invest identifies exceptional properties, pools together the resources of individual investors and purchases properties at a discounted prices:

Contact Value Invest today to find the right investment opportunity for you!

Continue reading interesting articles:

Why You Should Invest in the Fast Growing London Commuter Belt of England

Dubai Silicon Oasis

Building A1 Dubai

United Arab Emirates

© 2024 VALUE INVEST ALL RIGHTS RESERVED

© 2024 VALUE INVEST

ALL RIGHTS RESERVED